- All casinos accepting cryptocurrencies

- All cryptocurrencies

- Why do all cryptocurrencies rise and fall together

Why do all cryptocurrencies rise and fall together

For any company active in regions with shifting regulations, a clear understanding of their payment landscape is instrumental to smooth transition pa online lottery. For example, a lot of these regulations have something to do with transaction value – they might apply to everything over a specific value or exemptions might require a maximum value. Considering your average transaction value can help demonstrate whether it is worth exploring such exemptions.

The world of finance is undergoing a digital revolution. For a number of years now banks have looked at ways to use digitization to streamline processes, enhance efficiency, and improve customer experience, with varying degrees of success. However, the future of payments is venturing beyond just digitizing banking processes; it is about digitizing money itself.

Cryptocurrencies, once considered a niche market, are increasingly becoming part of mainstream financial transactions. Major companies like Tesla and PayPal have begun accepting Bitcoin and other cryptocurrencies as payment. This trend indicates a growing acceptance of digital currencies in everyday commerce. According to a report by Allied Market Research, the global cryptocurrency market is projected to reach $4.94 billion by 2030, growing at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2030.

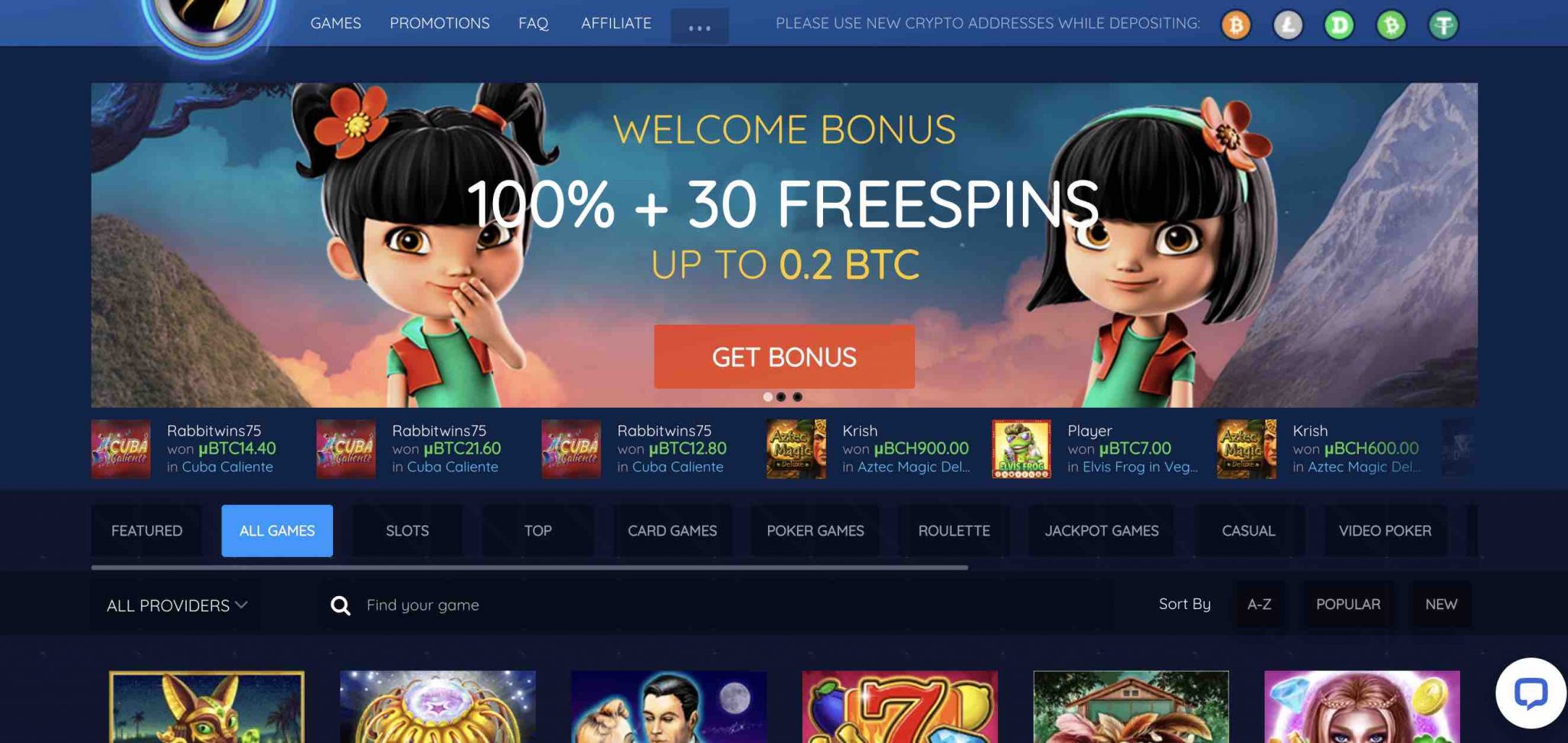

All casinos accepting cryptocurrencies

Due to its widespread acceptance and versatility, BNB has also become popular in the online gambling industry, particularly in BNB casinos. These casinos are online gambling platforms that accept BNB as a payment method, offering players the ability to engage in casino games such as slots, poker, and blackjack using Binance Coin.

Due to its widespread acceptance and versatility, BNB has also become popular in the online gambling industry, particularly in BNB casinos. These casinos are online gambling platforms that accept BNB as a payment method, offering players the ability to engage in casino games such as slots, poker, and blackjack using Binance Coin.

What should you choose when the desired result of playing casino games is the same regardless of the chosen method? Well, the fact of the matter is that there isn’t just one correct answer – you need to decide the method which is right for you.

Bitcoin and other crypto casinos do not differ much from classic online casinos. The main difference between PayPal, Skrill, VISA, and similar sites and crypto casinos is that you can make your deposits and withdrawals in cryptocurrency.

Winz, with over 8,000 games on offer, including popular slots, live casino games, and profitable bonus conditions, offers a comprehensive online casino experience. It accepts deposits in both crypto and fiat currencies, including Bitcoin, Ethereum, and Tether, and offers a generous welcome bonus where users can win up to 0.1 BTC with a Golden Spin. In terms of payment options, Winz is somewhat more flexible than other cryptocurrency casinos, as it accepts deposits in both crypto and fiat currencies.

Yes, people can and do win big in Bitcoin casinos. Similar to long-established casinos online, Bitcoin casinos offer a range of games such as poker, slots, and roulette, where players can win substantial amounts. Some Bitcoin casinos even have progressive jackpots where the prize pool increases over time until someone wins, which can result in enormous payouts.

All cryptocurrencies

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Cryptocurrency prices are affected by a variety of factors, including market supply and demand, news, and government regulations. For example, news about developments in a cryptocurrency’s underlying technology can affect its price, as can news about government regulations. Also, the supply and demand of a particular cryptocurrency can affect its price. Finally, market sentiment and investor confidence in a particular cryptocurrency can also play a role in its price. We cover sentiment and technical analysis for example you can check top coins : Bitcoin, Ethereum, XRP, Cardano, Dogecoin.

One of the biggest winners is Axie Infinity — a Pokémon-inspired game where players collect Axies (NFTs of digital pets), breed and battle them against other players to earn Smooth Love Potion (SLP) — the in-game reward token. This game was extremely popular in developing countries like The Philippines, due to the level of income they could earn. Players in the Philippines can check the price of SLP to PHP today directly on CoinMarketCap.

Why do all cryptocurrencies rise and fall together

In the U.S., discussions about reversing digital asset regulations have caused market volatility. The potential elimination of the IRS’s crypto broker rule has further fueled uncertainty. These examples demonstrate how regulatory decisions can create ripple effects across the cryptocurrency market.

Technological advancements in blockchain security aim to prevent such incidents. Enhanced encryption protocols and decentralized systems reduce the risk of breaches, restoring trust among investors. However, even minor security concerns can create ripples in the market. This highlights the delicate balance between technological reliability and investor sentiment in determining cryptocurrency prices.

Different cryptos come with varying visions regarding the direction of their project. Besides, the quality of the blockchains housing them is also an important price-determining factor. Coming to the project, the overall security and network adoption make the related blockchain crypto move up or down in terms of prices. The desirable metric here is to have a growing number of nodes, which indicates a strong and growing community. Further, an increasing number of nodes makes the project sufficiently decentralized. Hence, more brownie points for the project and the related crypto.

Risk-on and risk-off environments, usually created by central bank policies and macroeconomic conditions, also play a major role in the movement of cryptocurrencies. These environments influence both traditional stocks and cryptocurrencies similarly. During a risk-on phase, investors are willing to take more risks, leading to a rise in the value of cryptocurrencies. Conversely, in a risk-off phase, investors tend to move towards safer investments, causing a decrease in the value of cryptocurrencies.

Bitcoin’s decentralized nature and limited supply make it an appealing hedge against inflation. Unlike fiat currencies, Bitcoin operates without counterparty risk, offering a secure store of value. Historical data shows that rising sovereign risk often correlates with increased Bitcoin adoption. For example: